How Are Expert Networks Utilized In Investment Research?

Imagine you’re about to embark on an exciting journey into the world of investment research. You’re curious to learn about an essential tool called expert networks and how they shape this field. Well, look no further! In this article, we’ll explore the question, “How are expert networks utilized in investment research?”

Expert networks are like a secret weapon for investors seeking valuable insights and knowledge. These networks connect professionals from various industries to investors who want to make well-informed decisions. It’s like having a direct line to experts who can share their expertise and help you navigate the complexities of the market.

So, whether you’re a newbie investor or a seasoned pro, understanding how expert networks are used in investment research is crucial for gaining a competitive edge. Let’s dive in and explore the fascinating world of expert networks together!

How are Expert Networks Utilized in Investment Research?

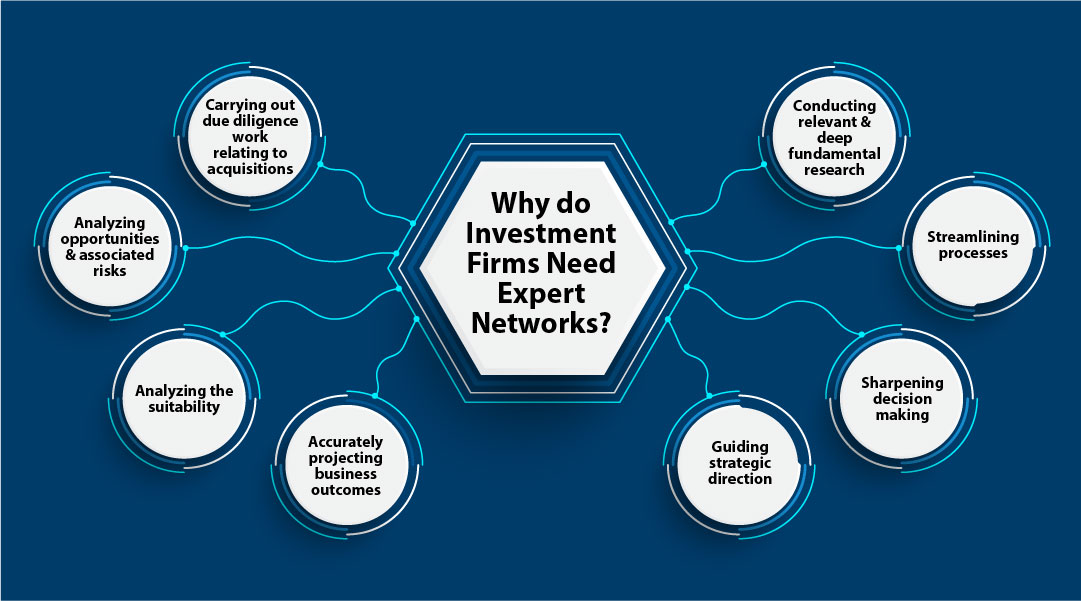

Expert networks play a crucial role in investment research by providing professionals with access to specialized knowledge and industry insights. In this article, we will explore how expert networks are utilized in investment research and the benefits they offer to investors. From assisting with due diligence to gaining a competitive edge in the market, expert networks have revolutionized the way investment research is conducted.

The Role of Expert Networks in Investment Research

Expert networks serve as a bridge between investors and industry professionals, connecting them through consultations or direct interactions. These networks consist of highly experienced individuals who possess significant expertise in specific sectors or industries. Investors can tap into this vast pool of knowledge to gain valuable insights and make informed investment decisions.

One primary way expert networks are utilized in investment research is through consultation services. Investors can engage with industry experts and seek advice or clarification on particular investment opportunities or market trends. These consultations can help investors identify potential risks, validate investment theses, and gain a deeper understanding of market dynamics.

Additionally, expert networks also facilitate informational interviews, where investors have the opportunity to gather firsthand information from professionals working within a specific sector. These interviews provide valuable insights into industry trends, competitive landscapes, and emerging opportunities that may not be readily available through public sources. By leveraging the expertise of these professionals, investors can get a comprehensive view of a particular industry and make well-informed investment decisions.

Expert networks also support investors by conducting market research and due diligence. They can provide access to proprietary research reports, industry analysis, and market forecasts, enabling investors to stay ahead of the curve. This information is especially valuable for investors who are considering entering new markets or industries, as it helps them assess the viability of investment opportunities and the potential risks involved.

The Benefits of Utilizing Expert Networks in Investment Research

When it comes to investment research, expert networks offer several key benefits that can give investors a competitive edge in the market.

1. Access to Specialized Knowledge: Expert networks provide investors with access to experts who possess in-depth knowledge and experience in specific industries. This access allows investors to tap into specialized insights and gain a deeper understanding of the intricacies of an industry or sector.

2. Time and Cost Savings: Conducting comprehensive research in-house can be time-consuming and costly. By utilizing expert networks, investors can save valuable time and resources by outsourcing research to professionals who are already well-versed in the subject matter.

3. Enhanced Due Diligence: Expert networks help investors conduct thorough due diligence by offering access to industry experts and insiders who can provide unbiased insights and assessments. This helps investors make more informed decisions and reduces the risk of making costly mistakes.

4. Competitive Advantage: By gaining access to exclusive information and insights, investors can gain a competitive advantage in the market. This can translate into better investment opportunities, higher returns, and a stronger position in the industry.

5. Networking Opportunities: Engaging with industry experts through expert networks provides investors with networking opportunities that can unlock future business collaborations, partnerships, and potential investments.

6. Mitigating Risks: By seeking advice and guidance from experts, investors can mitigate risks and avoid potential pitfalls, thereby increasing their chances of success.

In conclusion, expert networks play a crucial role in investment research by providing investors with access to specialized knowledge, industry insights, and networking opportunities. By leveraging the expertise of industry professionals, investors can make more informed investment decisions, stay ahead of the competition, and mitigate risks. Expert networks have revolutionized the way investment research is conducted, providing a valuable resource for investors looking to gain a competitive edge in the market.

Key Takeaways: How are expert networks utilized in investment research?

- Expert networks connect investors with industry professionals who provide valuable insights and knowledge.

- Investors utilize expert networks to gain a deeper understanding of potential investments and industries.

- Expert networks provide access to expert opinions, market trends, and specialized knowledge that can help investors make informed decisions.

- Investment professionals leverage expert networks to validate investment theses, mitigate risks, and uncover unique investment opportunities.

- By tapping into expert networks, investors can save time and resources by accessing expertise and information that may be inaccessible or time-consuming to gather independently.

Frequently Asked Questions

Expert networks play a crucial role in investment research, providing valuable insights and knowledge to investors. Here are some common questions about how expert networks are utilized in investment research:

1. How do expert networks aid in investment research?

Expert networks act as a bridge between investors and industry professionals. They connect investors with subject matter experts who have in-depth knowledge and experience in specific industries or sectors. These experts provide valuable insights, which help investors gain a better understanding of market trends, emerging technologies, regulatory changes, and other factors that impact investment decisions.

By utilizing expert networks, investors can access a wide range of industry experts, gaining unique perspectives and information that may not be easily accessible through traditional research methods. This collaboration allows investors to make more informed investment decisions, mitigate risks, and identify potential opportunities early on.

2. How are expert networks different from traditional research methods?

Expert networks differ from traditional research methods in several ways. While traditional methods often rely on published reports and publicly available information, expert networks offer direct access to industry experts who possess insider knowledge and real-time insights. This allows investors to go beyond what is publicly known and gain a deeper understanding of specific industries or companies.

Expert networks also enable investors to ask specific questions and receive tailored information, whereas traditional research methods may not provide the same level of personalized interaction. Moreover, expert networks can expedite the research process by quickly connecting investors with relevant experts, saving both time and resources.

3. How do investors choose the right expert network for their research?

Choosing the right expert network depends on various factors. Investors should consider the network’s reputation, the expertise of its members, and the industries it covers. It is important to select a network that aligns with the investor’s specific research needs and investment focus.

Additionally, investors should assess the network’s communication and support systems to ensure efficient and seamless collaboration with the experts. It can be helpful to obtain recommendations from colleagues or industry professionals who have experience working with expert networks.

4. Are expert networks only suitable for large institutional investors?

No, expert networks are not limited to large institutional investors. While institutional investors often utilize these networks for their research needs, expert networks can also be beneficial for individual investors, small fund managers, and even retail investors.

Expert networks provide valuable insights that can enhance investment decision-making regardless of the investor’s size or experience. They offer a cost-effective way to access industry experts who can provide specialized knowledge and help level the playing field for investors of all types.

5. How do expert networks maintain confidentiality and avoid conflicts of interest?

Confidentiality and avoiding conflicts of interest are essential aspects of expert networks. These networks have strict protocols and safeguards in place to protect the privacy and confidentiality of both the experts and investors. Non-disclosure agreements (NDAs) are commonly used to ensure the confidentiality of discussions and shared information.

Expert networks also take measures to prevent conflicts of interest by ensuring that their experts adhere to ethical guidelines. They typically have policies in place to address potential conflicts and maintain objectivity in the information provided to investors.

EXPERT NETWORK

Summary

Expert networks are used in investment research to connect investors with industry professionals. These professionals offer insights and expertise that help investors make better, informed decisions.

Expert networks can provide valuable information on specific industries and companies. They can help investors understand market trends, identify potential investment opportunities, and gain a competitive edge in the market.

By leveraging the knowledge and experience of industry professionals, expert networks play a crucial role in enhancing investment research and improving investment outcomes. They provide investors with a unique perspective and access to information that may not be readily available through traditional research methods. In this way, expert networks empower investors to make more informed and successful investment decisions.